Invoicing may be more important than you think. One of the reasons is because late payments link to about one in four business bankruptcies in Europe. In the last few years, the rate of companies facing trouble because of late invoices reached its highest point in decades. These numbers explain why many landlords now treat invoices as active business signals. Why good e-invoicing software sits in the middle of that flow of money and trust.

Getting e-invoicing right can change how healthy your real estate portfolio is.

Why e-invoices now sit in the spotlight

A few things have shifted at the same time.

- Late payments carry real risk

- Around 47% of EU businesses run into payment problems because of late customer invoices.

- Research links late invoices to up to 25% of bankruptcies.

- Manual invoices create slow leaks

- Studies show that 1 to 3 percent of manually processed invoices contain errors.

- A tiny error in a rent spreadsheet spreads fast across a portfolio.

- Regulators now focus on digital invoice data

- The EU’s VAT in the Digital Age package relies on structured e-invoicing, not PDFs.

- Tax offices in many regions now expect clear invoice data that systems can read without manual work.

Your invoicing process has become a live feed of cash flow, compliance and reputation.

This makes the choice of your e-invoicing software part of your risk management, not simply an admin decision.

What e-invoicing software quietly improves

Modern e-invoicing solutions fix the common weak points in manual workflows. They:

- turn invoices into structured data, not files lost in inboxes

- convert formats automatically to meet EN 16931 and other standards

- route invoices through trusted channels such as Peppol or national platforms

- reduce retyping and cut human error at the root level

For landlords and property managers this means:

- fewer tenant disputes about unclear bills

- fewer adjustments during audits

- faster processing

- a clearer view of delays and cash flow patterns

E-reporting tools also send invoice data directly to tax authorities when required. This keeps VAT information tidy and prevents end of month stress.

Why rental real estate feels this shift more

In real estate, one mistake can echo across many units.

You work with:

- long leases with index updates

- mix of residential and commercial tenants

- utility charges, service fees and shared cost splits

- country specific VAT rules

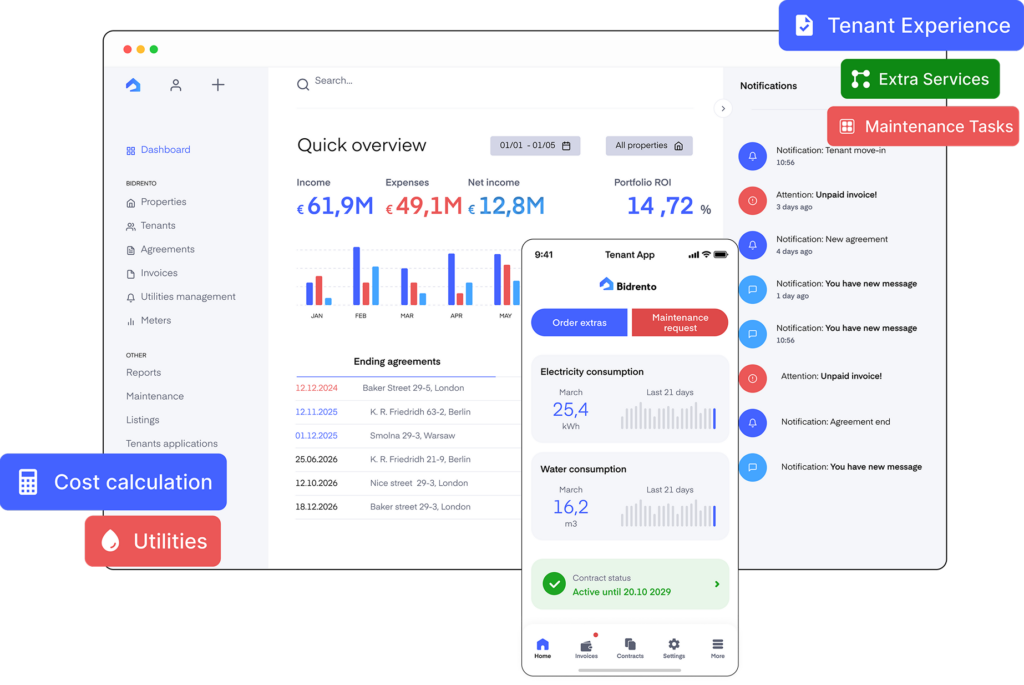

Generic billing tools struggle with the layers behind each rent invoice. Sector specific e-invoicing solutions like Bidrento handle the real life logic of leases, meters and tenants.

Bidrento then connects smoothly to wider finance and compliance tools, including e-invoicing software and e-invoicing solutions, so the whole stack stays clean.

When your invoicing base is stable, the rest of your operations settle as well.

E-invoicing explained

Studies show that e-invoicing can cut invoice processing costs by 60 to 80 percent and speed up payment cycles at the same time.

That kind of saving does not come from “sending PDFs by email”. It comes from proper e-invoicing software and well built e-invoicing solutions that treat every invoice as structured data, not as a loose file.

Let us keep this section very plain. No jargon, just what you actually need to know.

What e-invoicing really means

Most people hear “e-invoice” and think of a PDF attached to an email.

Tax offices think of something else.

The European Commission and the EN 16931 standard define an e-invoice as a structured, machine readable invoice that a system can read without a human retyping it.

In practice that means:

- the invoice is built as data, often XML or UBL

- it follows a common EU data model

- it travels from your system into your customer’s system in that clean format

A PDF invoice is more like a picture of a bill, while a real e-invoice is a set of fields that a computer can understand and check automatically.

Good e-invoicing software does all that in the background. You still see an invoice on the screen. The data underneath is what matters.

What e-invoicing software actually does all day

In very simple terms. They:

- create invoices from your data

- convert them into the right formats

- send them out through the right channels

- add payment buttons and reminders

- connect to networks like Peppol, their own Banqup network, or even print and post if needed.

That is a neat summary of what good e-invoicing software should do for you.

A strong e-invoicing solution will normally:

- take invoices from your ERP, property system or accounting tool

- validate key fields such as VAT number, totals and tax rates

- convert invoices to EN 16931 or local formats

- deliver them to buyers through Peppol, national portals or email

- track status, for example delivered, accepted, rejected

Some e-invoicing solutions also come with portals where suppliers and customers can see invoice history, download copies and send replies.

In short, e-invoicing software takes all the dull parts of invoicing and makes them boring and reliable. That is a compliment.

Why tax offices care so much

You might quietly wish that tax offices did not care this much about your invoicing data. Sadly, they do.

The OECD and the EU both now see e-invoicing as part of VAT control. In many countries, structured e-invoices are sent to tax authorities in real time or near real time.

This shift is visible in many places:

- Digital Reporting Requirements in the EU

- Cross border B2B invoices must be reported transaction by transaction.

- Real time or two day reporting is the target in the ViDA package.

- National systems

- Some states use national clearance platforms where invoices or data go to tax offices first.

- Others use near real time reporting, as Spain does with its SII model.

For a landlord or property manager this matters because rent invoices, service charges and utility bills all feed into VAT reports. If your e-invoicing solution sends clean data, life with tax authorities feels much calmer.

Why bother if you “only” send PDFs today

You might think, “We have sent PDFs for years. Tenants pay. Why change”. Fair question.

There are a few blunt but helpful points:

- Manual PDF invoices often need someone to retype data. Each manual step lifts error rates and slows approval.

- Studies from Europe and New Zealand show that e-invoicing solutions reduce mistakes, speed up processing and help firms get paid faster.

- Many European countries from the Baltics and Nordics down to Spain and Portugal are clearly moving toward mandatory e-invoicing for more types of businesses.

Here is the quiet angle that gets missed. Good e-invoicing software does not only please the tax office. It also gives you better internal data.

With proper e-invoicing solutions you can:

- track how long invoices sit in approval

- see which tenants or customers pay late

- segment invoices by building, unit, service type or country

- spot patterns in disputes, for example always around the same shared cost rule

So even before you think about mandates, e-invoicing software already gives your finance team a sharper view.

Supplier e-invoicing and customer e-invoicing in one picture

Many companies split how they view invoices. They think about outgoing invoices and incoming invoices as different worlds.

In reality, you want e-invoicing software that plays both sides of the table. Many e-invoicing solutions now offer:

- supplier e-invoicing

- suppliers send structured invoices into your system

- the software validates, matches and posts them

- customer e-invoicing

- you send structured invoices to tenants, banks and other clients

- they receive data that plugs straight into their own systems.

For a rental property business this means fewer surprises. Service invoices from third parties come in clean. Rent and utility invoices go out clean. Your property management system sits in the middle and stays in sync.

How this links back to rental real estate

So far we have talked about e-invoicing software in general terms. The logic applies to any sector.

Rental real estate adds extra layers:

- long term lease data

- indexation rules

- deposits

- shared cost allocation for utilities and services

- mixed VAT profiles across residential, retail and office units

Generic e-invoicing solutions do not know what to do with those layers. They are brilliant at transport, formats and status. They do not understand how to split an energy bill by meter reads or square metres. That is fine. They are not meant to.

This is why specialist tools like Bidrento matter. Bidrento handles leases, units, metering and utility cost allocation in detail, then passes clean invoice data into accounting and e-invoicing rails.

You get the best of both worlds. Sector logic in Bidrento. Strong e-invoicing software and e-invoicing solutions for delivery and compliance.

If you want to see how this looks in practice for rent, deposits and shared costs, you can book a free demo of Bidrento here.

E-invoicing software and tax office reporting, how both pieces work together

That speed is not realistic with spreadsheets and manual uploads. It calls for proper e-invoicing software that talks to tax systems without drama.

A small detail in the EU plans we linked above often goes unnoticed. From 2028 the European Commission wants cross border invoice data to reach tax offices within two days in a standard format.

Two distinct layers, invoice exchange and tax reporting

First layer. E-invoicing software handles the exchange of invoices between you and your tenants or suppliers. It sits between your property or ERP system and the outside world.

Good e-invoicing solutions will usually:

- pick up invoice data from your system in a simple way, for example through API or file export

- validate the key fields before anything goes out, such as VAT numbers, totals and tax amounts

- convert that data into the format each receiver expects, for example EN 16931 XML

- send invoices through secure networks, such as Peppol or national portals

- track status, for example delivered, accepted, rejected or paid

Second layer. E-reporting or tax office integration handles the relationship with tax authorities. Tools in this layer send structured data to tax systems on a schedule.

So in simple words:

- e-invoicing software speaks to your customers and suppliers

- e-reporting tools speak to tax offices

Sometimes both layers live on one platform.

For a landlord, this split is useful. It lets you choose:

- one or two strong e-invoicing solutions to cover the transport and tax layer

- one specialist property tool, like Bidrento, that covers rental logic and cost allocation

What tax offices actually want from your invoices

Tax authorities are not interested in your layout or colour choices. They care about a few core things.

Across EU and OECD guidance, three points repeat.

Tax offices want:

- Structured data

- line level details

- VAT rates and amounts

- buyer and seller VAT IDs

- Speed

- near real time or a few days after issue

- no long delays between invoice date and report

- Consistency

- data that ties to ledgers

- no double use of invoice numbers

- clear reversals and credit notes

Well built e-invoicing software makes this simple. They create data in the right shape at source. They reuse that data for both business partners and tax offices.

If your e-invoicing software handles format checks and basic VAT validation, many common problems disappear before they hit the tax office.

Why Bidrento is the Best Solution for E-Invoicing in Property Management

At Bidrento we focus where property businesses feel the most pain. Bidrento’s core strengths sit in:

- lease and tenant data

- recurring rent billing

- debt management

- utility cost calculation and shared cost allocation

- reporting on units, buildings and portfolios

In practice, Bidrento helps you:

- get the right numbers on each invoice

- apply the correct cost allocation rules

- time invoices in line with lease terms and indexation

- keep a clear record of who owes what and why

Once that part is clean, Bidrento can feed invoice data to e-invoicing software and broader e-invoicing solutions that handle:

- EN 16931 mapping

- Peppol routing

- KSeF integration in Poland

- SII style reporting in Spain

- digital reporting rules in other EU states

You keep strong property logic where it belongs. You keep tax and delivery logic in tools built for that job. The link between Bidrento and your e-invoicing software is where the two worlds meet.

How finance, tax and operations see benefits in different ways

One of the reasons good e-invoicing software wins support is that it gives something to each internal team.

For finance leaders:

- better visibility on outstanding invoices

- fewer manual corrections at month end

- smoother audit trails and fewer surprises

For tax and compliance:

- consistent data formats

- fewer missing or late submissions

- clear logs for tax authority queries

For property and operations:

- less pressure around cut off dates

- fewer disputes on invoices, because the inputs are right

- more time for actual asset and tenant work, less time feeding portals

When e-invoicing software and e-invoicing solutions sit properly under the property layer, meetings become less about “why did this invoice fail” and more about “what is this asset doing for us”. That is usually a more pleasant conversation.

The landlord’s simple e-invoicing checklist

If you want a short, practical checklist when speaking with providers, here is a starting point.

Questions for any e-invoicing software or e-invoicing solutions vendor:

- Which EU countries do you cover for both e-invoicing and e-reporting today

- Do you support EN 16931 and Peppol as standard

- How do you handle new mandates, such as KSeF in Poland or Crea y Crece in Spain

- Do you offer a single API for all countries, or separate ones

- Can you connect to my property management system, for example Bidrento, without manual exports

- How do you handle validation, error messages and status updates

Questions for your property management layer, for example Bidrento:

- Can you export invoice data in a structured, stable way

- Can you keep cost allocation logic, metre reads and lease rules transparent for tenants

- Can you support different VAT rules for residential, commercial and hospitality units

If both sides can answer well, you get a stack that matches what the EU and the UK are clearly building toward. Frequent digital data, simple structure, less guesswork.

Where Bidrento solves the real pain: cost allocation and utility billing

In many commercial and residential buildings, 30 to 50 percent of the total occupancy cost comes from service charges and utilities, not from base rent. Yet most landlords still keep these important numbers in messy spreadsheets, email threads and half manual workflows.

So the place where tenants pay the most attention often sits on the weakest process. E-invoicing software and e-invoicing solutions can move those invoices very fast. If the numbers are wrong, they move the errors fast as well.

Bidrento takes a different path. It starts where the pain begins, at cost allocation and utility billing, then hands clean data to your e-invoicing software.

Let us walk through what that means in real life.

One rulebook for shared costs, not fifty spreadsheets

Bidrento’s utility cost and cost allocation module is built for shared expenses, not as an afterthought. The platform lets you define how to split costs across units using:

- individual meter readings

- square metre shares

- fixed monthly fees

- custom rules for special leases or caps

You set the rules once for:

- energy, water and heating

- cleaning and security

- lifts, HVAC and other technical systems

- common area maintenance and other shared services

Then Bidrento applies these rules each billing cycle.

The system tracks both operating expenses and capital expenses, so you can decide which items are recoverable and which stay on the landlord side.

This is different from the usual Excel approach. In a spreadsheet, each new property or lease variation tends to spawn its own file. In Bidrento, the logic lives in a single rules engine inside your property platform.

Once that base is clean, e-invoicing software has something solid to work with. E-invoicing solutions can carry the cost splits to tenants and tax offices without guessing what sits behind each line.

From meters and invoices to allocation, all in one chain

The real magic is in the full flow, from raw data to final invoice.

Bidrento supports:

- input of master utility invoices at building or site level

- storage of individual meter readings by unit

- automatic checks for missing or outdated readings

- real time meter data where integration allows, so you see patterns early

Tenants can enter their own readings through the Bidrento Tenant App, and they can see their consumption over time. This simple step trims many “I never used that much” discussions. The readings are in the app. The history is there.

Once you have:

- the master bill from the utility supplier

- the readings per unit

- the rules for who pays what

Bidrento calculates the share per tenant and prepares invoice lines. The system can also handle:

- minimum and maximum limits

- loss factors in older buildings

- special treatment for vacant units

At this point, your e-invoicing software receives a clean set of lines. It does not need to know the logic behind “CAM service code 104”. The allocation has already happened upstream.

This is the healthy split of labour. Bidrento does the property work. E-invoicing solutions do the transport, formats and tax integration work.

Utility billing as a trust test

Tenants rarely phone to praise a correct rent invoice. They do call when a utility bill looks odd. Bidrento helps you in those situations in three simple ways:

- Clear structure

- invoices show separate lines for rent, utilities and extra services

- service charge and utility lines follow the same naming across the portfolio

- Tenant view of data

- tenants see their invoices, agreements and meter readings in one app

- they can track their own usage over time, not only see the end bill

- Back up for your team

- property managers can pull reports by building, unit or service type

- finance teams can trace a single invoice back to the original cost and reading

Once tenants feel that the numbers are clear and stable, they pay more calmly. This is where e-invoicing software like Bidrento multiplies the benefit.

When you send structured, timely invoices through e-invoicing solutions, those good invoices land faster and with fewer technical hiccups.

So you get both psychological and technical trust.

Automated invoicing on top of allocation, no retyping

Bidrento does not stop at the allocation step. It also automates invoicing across rent, utilities and other services.

The invoicing management features cover:

- rent invoices based on leases and indexation rules

- automatic updates when rent changes

- monthly utility invoices based on cost allocation

- invoices for extra services, such as parking, storage or cleaning

- bulk actions when you want to invoice whole buildings or portfolios in one go

Because Bidrento tracks payments and integrates with banks and accounting systems, it can also support automated debt management.

Now add e-invoicing software to this picture. The clean flow looks like:

- Bidrento generates rent and utility invoices from leases and allocation rules.

- Bidrento passes invoice data through an API or export.

- Your e-invoicing solutions convert and deliver invoices to tenants, business customers or public sector bodies.

- The same e-invoicing software handles status, reminders and links to e-reporting for tax.

No one retypes invoice lines. No one copies amounts by hand into a portal at the end of the month. The systems talk. The team monitors.

This is where landlords start to see the benefit in real hours.

Bidrento's customers like Telliskivi Creative City and RigaHub enjoy automated invoicing and utility calculations, which cut manual work and give them a faster way to grow their portfolios with a lean team.

How this plays out for different asset classes

The nice part of Bidrento’s approach is that it works across many asset types. The same core logic supports:

- residential blocks and housing associations

- build to rent and multifamily

- retail and shopping centres

- office and co working space

- student housing and co living

- short stay and hospitality sites

The details differ by asset class. For example:

- retail sites care a lot about common area maintenance and footfall based services

- office buildings focus on HVAC, lifts and cleaning schedules

- student housing and co living often use blended packages for utilities and services

Bidrento keeps the same base. Clear rules, clear meters, clear invoices.

E-invoicing software and e-invoicing solutions then provide a stable way to work with:

- international retail tenants who demand structured e-invoices

- public sector tenants who want Peppol based invoices

- cross border owners who centralise finance in one hub

So you do not need a different billing stack for each asset class. You keep property logic in Bidrento and use the same e-invoicing software layer across the group.

Why this matters for your balance sheet, not only your inbox

It is easy to see cost allocation and utility billing as admin work.

In practice, they touch three parts of your balance sheet.

- Revenue and cash flow

- fewer unbilled utilities and missed service charges

- faster payments when tenants trust the math and receive invoices via solid e-invoicing solutions

- Operating costs

- less manual work in finance and property teams

- fewer disputes and write offs

- better data for tendering suppliers when you know real usage

- Asset value

- investors and banks look at net operating income and stability

- stable, transparent billing supports higher valuations

- integrated e-invoicing software makes your numbers easier to verify during due diligence

So when you fix cost allocation and utility billing with Bidrento and connect it to strong e-invoicing software, you are not polishing a back office process. You are strengthening cash flow, tenant trust and valuation at the same time.

If you would like to see how this looks on real buildings, with your own mix of rent, utilities and services, you can book a free demo of Bidrento here

How to Simplify Complex E-invoicing with Bidrento

Infortar is one of the most active investment groups in the region. Its portfolio covers energy, logistics, shipping and a large mix of commercial real estate. Think long lease office space, retail, terminals and various special use sites. Complexity is part of the job description.

Before Bidrento, a big part of that complexity sat in:

- separate spreadsheets for different properties

- manual adjustments for indexation

- heavy use of email and files between property and finance teams

Their partnership with Bidrento brings operational excellence and portfolio scalability, with a clear focus on automating lease management, invoicing and reporting.

Bidrento now helps Infortar to:

- keep lease data, rent, and indexation rules in one system

- automate recurring invoices based on actual lease terms

- calculate and allocate utilities and service charges in a repeatable way

- provide portfolio level reports that finance teams can trust

This is where Bidrento's role as e-invoicing software becomes key. When Bidrento outputs clean invoice data for hundreds or thousands of tenants, e-invoicing solutions can:

- convert invoices into EN 16931 formats for business tenants

- route invoices through networks such as Peppol where needed

- push VAT relevant data into tax reporting flows

In a group as diverse as Infortar, this split has a clear benefit. Bidrento handles the fine detail of each property. The chosen e-invoicing software handles formats, delivery and tax connections for the entire group. The teams get one consistent view of invoices, not five slightly different versions per unit

Short E-Invoicing FAQ. Answers to common questions

Here are the questions landlords and portfolio managers ask most often when they hear about e-invoicing software and e-invoicing solutions. Simple answers, no jargon, just what you need to know.

What is e-invoicing in simple words?

E-invoicing means sending and receiving invoices as structured data, not as PDFs.

According to the European Commission, an electronic invoice is a machine readable invoice that accounting systems can read and book without manual typing.

So in practice:

- You create the invoice in your system.

- Your e-invoicing software turns it into a standard format, such as EN 16931 XML.

- The invoice goes directly into the customer’s system.

No one retypes lines. No one squints at PDFs.

2. How is e-invoicing different from sending PDF invoices by email?

A PDF looks digital, but for most tax offices it still counts as “paper on a screen”.

Key differences:

- A PDF is a picture. Someone must read it and type the data into another system.

- A real e-invoice is structured data. Systems can import it directly.

- Tax rules in the EU are built around structured e-invoices, not email attachments.

Good e-invoicing software can send PDFs if needed, but its main job is to send proper e-invoices that machines can process without human effort.

3. What does e-invoicing actually do for my rental business?

For a landlord or property manager, e-invoicing software pays off in a few very practical ways. Research across Europe shows that electronic invoicing can:

- cut invoice handling costs by 60 to 80 percent compared with paper flows

- reduce errors, because data goes straight from system to system

- bring payments forward by 5 to 19 days on average, thanks to faster processing and fewer mistakes

When you pair Bidrento with strong e-invoicing solutions, you also get:

- correct rent and utility lines from Bidrento

- structured invoices sent out by your e-invoicing provider

- clean data for banks, investors and tax offices

This is why many larger landlords treat e-invoicing software as part of their finance and risk setup, not just as a billing tool.

4. Do landlords in the EU or UK really need e-invoicing software?

Short answer, if you own more than a few units, yes, you should plan for it.

In the EU:

- The ViDA package will make real time or near real time digital reporting standard for cross border B2B invoices by 2030.

- Many states, such as Germany, Poland, Spain and Estonia, already push structured e-invoices through national rules.

In the UK:

- Landlords over set income thresholds must keep digital records and send quarterly updates under Making Tax Digital from 2026 onwards.

You could try to meet these rules with simple accounting tools and spreadsheets. In practice, most professional landlords use at least one e-invoicing solution to handle formats, tax connections and invoice status.

Bidrento then feeds those tools with correct property level data.

5. How do e-invoicing and tax office reporting link together?

Think of two separate but connected jobs.

E-invoicing software:

- creates structured invoices

- checks key data, such as totals and VAT rates

- sends invoices to tenants and suppliers

- tracks delivery status

E-reporting and tax integration:

- takes the same invoice data

- maps it to each country’s tax schema

- sends it to tax portal APIs on time, for example for Making Tax Digital or EU digital reporting

Some platforms combine both. They work as e-invoicing solutions and as tax reporting tools in many countries.

For a landlord using Bidrento, this means:

- Bidrento calculates rent, service charges and utilities.

- Your e-invoicing software sends those invoices to tenants.

- The same system, or a linked module, reports the data to tax offices.

You avoid double work and you keep one clear line of data from lease to tax.

6. How does e-invoicing help with shared utility costs and service charges?

On its own, e-invoicing software does not decide who pays which share. That is Bidrento’s job.

The combination works like this:

- Bidrento uses its utility cost calculation module to split master invoices across units, based on metre readings, square metres or other rules.

- Bidrento creates rent and service charge invoices with clear lines for utilities and shared costs.

- Bidrento sends those invoices in a structured format to tenants and accounting tools.

7. Can Bidrento work with my current accounting and e-invoicing tools?

Yes, that is the whole point. Bidrento is built to sit in a wider finance stack.

Bidrento offers or supports:

- integrations with accounting systems such as Xero and Microsoft Dynamics 365

- export of structured invoice data

- bank integrations for payment matching and debt management

Your e-invoicing software then connects on the accounting side or directly on the invoicing side. In both cases, you use e-invoicing solutions to:

- send structured invoices to tenants and suppliers

- receive structured invoices from utilities and service partners

- feed data into VAT and Making Tax Digital workflows

So you do not have to give up your accounting platform. You add Bidrento on the property side and pick e-invoicing software that speaks to both.

8. What should I look for when choosing e-invoicing software as a landlord?

A short checklist for landlords and asset managers:

Look for e-invoicing solutions that:

- support EN 16931 and Peppol as standard for EU work

- cover the countries where you own assets, for example Germany, Poland, Spain, Malta, Baltics and the UK

- connect to tax office APIs for e-reporting where needed

- offer one simple interface and API, not a different portal per country

- integrate with property tools such as Bidrento and with your accounting system

In addition:

- export clean, structured invoice data

- keep lease and cost allocation rules transparent

- handle mixed residential, commercial and hospitality portfolios in one place

Bidrento can take care of that for you.