For the landlord, the rental price and the resulting monthly income are one of the most important aspects their rental business. The desired rental price is often used as a basis for selecting a tenant and making future investments. However, the cost of an empty apartment is often not taken into account.

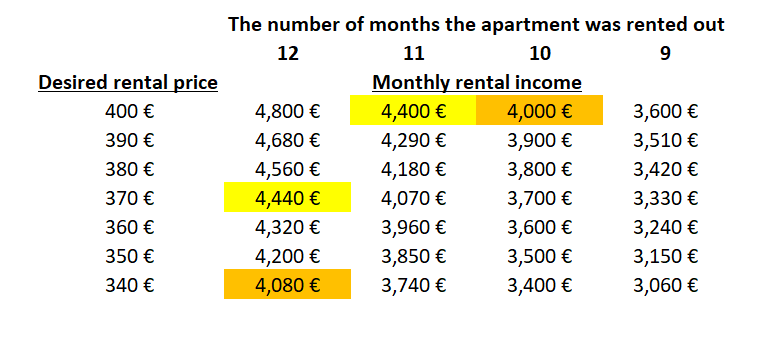

To explain this situation, we have put together a simple price matrix. In this matrix, we use an example to show that a rental property that has been vacant for a month will generate the same "loss” as it would be if the landlord will reduce the rental price by 7-8%.

Photo: Bidrento

Then, what is the most useful decision landlord should make? Is it to stay looking for a tenant who is willing to pay a desired rental price, but who may take several months to find, or lower the price by 5% and find a suitable tenant immediately?

Based on the matrix, it becomes clear that it would be most beneficial for the landlord to agree to lower a rental price by 5% and rent out property immediately. In addition to the loss of rental income, the vacant apartment also generates other maintenance costs - like utility bills and etc - that the landlord has to pay from his or her pocket. Before you say no to a lower rental offer, you should therefore consider and consider whether a 5% discount might be an option after all.

Photo: Bidrento

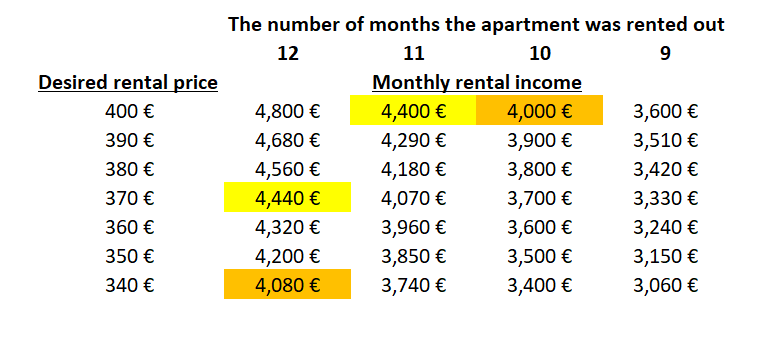

Then, what is the most useful decision landlord should make? Is it to stay looking for a tenant who is willing to pay a desired rental price, but who may take several months to find, or lower the price by 5% and find a suitable tenant immediately?

Based on the matrix, it becomes clear that it would be most beneficial for the landlord to agree to lower a rental price by 5% and rent out property immediately. In addition to the loss of rental income, the vacant apartment also generates other maintenance costs - like utility bills and etc - that the landlord has to pay from his or her pocket. Before you say no to a lower rental offer, you should therefore consider and consider whether a 5% discount might be an option after all.

Photo: Bidrento

Then, what is the most useful decision landlord should make? Is it to stay looking for a tenant who is willing to pay a desired rental price, but who may take several months to find, or lower the price by 5% and find a suitable tenant immediately?

Based on the matrix, it becomes clear that it would be most beneficial for the landlord to agree to lower a rental price by 5% and rent out property immediately. In addition to the loss of rental income, the vacant apartment also generates other maintenance costs - like utility bills and etc - that the landlord has to pay from his or her pocket. Before you say no to a lower rental offer, you should therefore consider and consider whether a 5% discount might be an option after all.

Photo: Bidrento

Then, what is the most useful decision landlord should make? Is it to stay looking for a tenant who is willing to pay a desired rental price, but who may take several months to find, or lower the price by 5% and find a suitable tenant immediately?

Based on the matrix, it becomes clear that it would be most beneficial for the landlord to agree to lower a rental price by 5% and rent out property immediately. In addition to the loss of rental income, the vacant apartment also generates other maintenance costs - like utility bills and etc - that the landlord has to pay from his or her pocket. Before you say no to a lower rental offer, you should therefore consider and consider whether a 5% discount might be an option after all.