There is one number that many landlords would rather not see in print.

Research from utility and billing specialists suggests that manual errors and oversights can leave up to 12 percent of utility costs unbilled, and that around 40 percent of tenant complaints relate to utility bills that tenants do not understand or trust.

This is the quiet reason why rental invoicing feels tense. It is not just about sending a rent line once a month. It is about slicing shared costs, checking utility data, applying lease rules and then surviving the audit, the tenant challenge and the tax check in one piece.

Professional e-invoicing software helps with speed, structure and tax links. They do not remove the underlying complexity of rent, service charges and utilities. That part lives in the property logic.

Let us break that complexity down.

How a “simple rent invoice” turns into a small puzzle

In many sectors, an invoice has three lines. Product, quantity, price.

In a rental portfolio, even a standard month often involves:

- base rent

- indexation or market review adjustments

- service charges or recoverable expenses

- utilities

- extra services, such as parking or storage

- VAT treatment that depends on use and country

Service charges and recoverable expenses alone can cover:

- cleaning of common areas

- security and access control

- lifts and HVAC systems

- gardening and snow removal

- building management and admin fees.

Each of these has its own rules. Some are fully recoverable. Some are capped. Some are shared across all tenants. Some apply to a specific floor or unit class only.

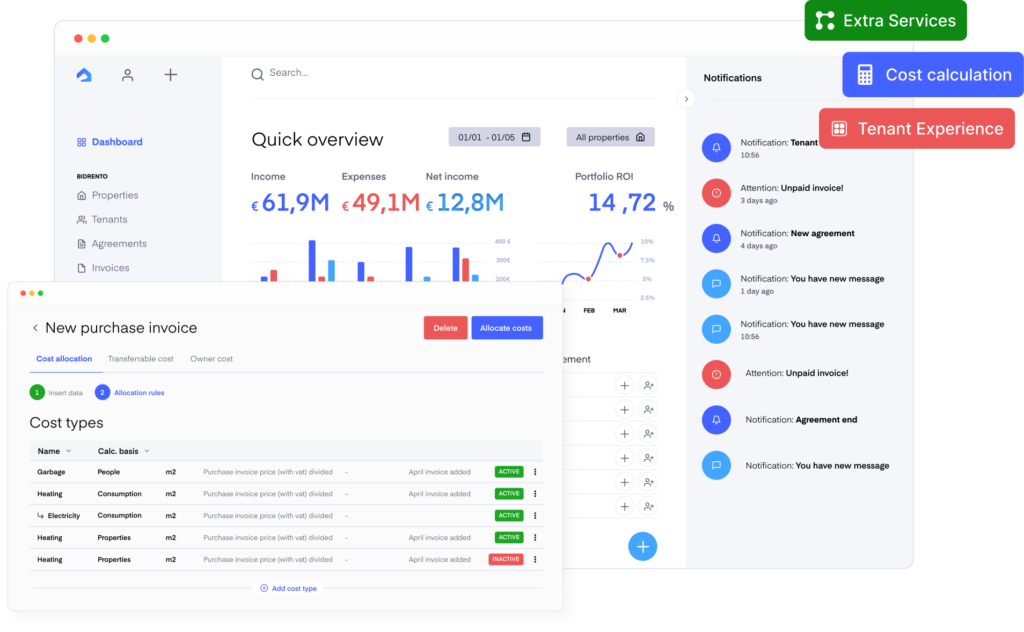

This is why a rental invoice has more moving parts than a standard sales invoice. E-invoicing software like Bidrento can solve this puzzle for you.

Why shared cost allocation creates tension so quickly

Shared costs are not a side detail. They can make up a large part of the monthly bill. In some commercial properties in Europe, service charges and shared costs can reach levels where they materially shift the total occupancy cost and trigger legal disputes when tenants feel misled or overcharged.

Three things make shared cost allocation hard.

- Different formulas in different leases

- some tenants pay by square metres

- some by actual metre readings

- some by a hybrid model with caps on “controllable expenses”x

- Moving cost base

- energy and cleaning prices move during the year

- capital works come in at odd times

- some costs are clearly landlord costs and should not sit in the pool

- Transparency pressure

- professional codes and case law in the UK and Europe stress that service charge costs must be clear and justified

- new rules and guidance push landlords to present well structured service charge statements and keep back up records ready

When this logic lives in a spreadsheet on one person’s laptop, you get:

- wrong pro rata shares for some tenants

- missed exclusions

- small errors that repeat all year

E-invoicing software will faithfully send those errors to tenants and tax offices at high speed. That is not quite the goal. You want e-invoicing solutions that receive clean data from a property system which handles cost allocation properly.

Utility billing, where small mistakes become big money

Utility billing is where data volume, human error and real cash meet. Studies in the multifamily sector report that at least 17 percent of utility invoices contain an error before review.

Other research notes that portfolios can lose hundreds of thousands of pounds a year because of billing mistakes, late fees and unbilled usage. GeoSphere™+2Zego+2

Common issues include:

- meter readings missing or misread

- vacant units with active heating or cooling

- master invoices split using wrong formulas

- old rates used after tariff changes

Property teams often try to fix these issues with manual checks. They compare master invoices to sub meter data, then build their own allocation logic. It is careful work. It is also slow and tiring.

Good e-invoicing software can help with part of the story by:

- checking that totals match

- storing invoice history cleanly

- feeding data into accounting and reporting tools

The deeper issue is how you calculate the individual tenant share in the first place. That is property logic.

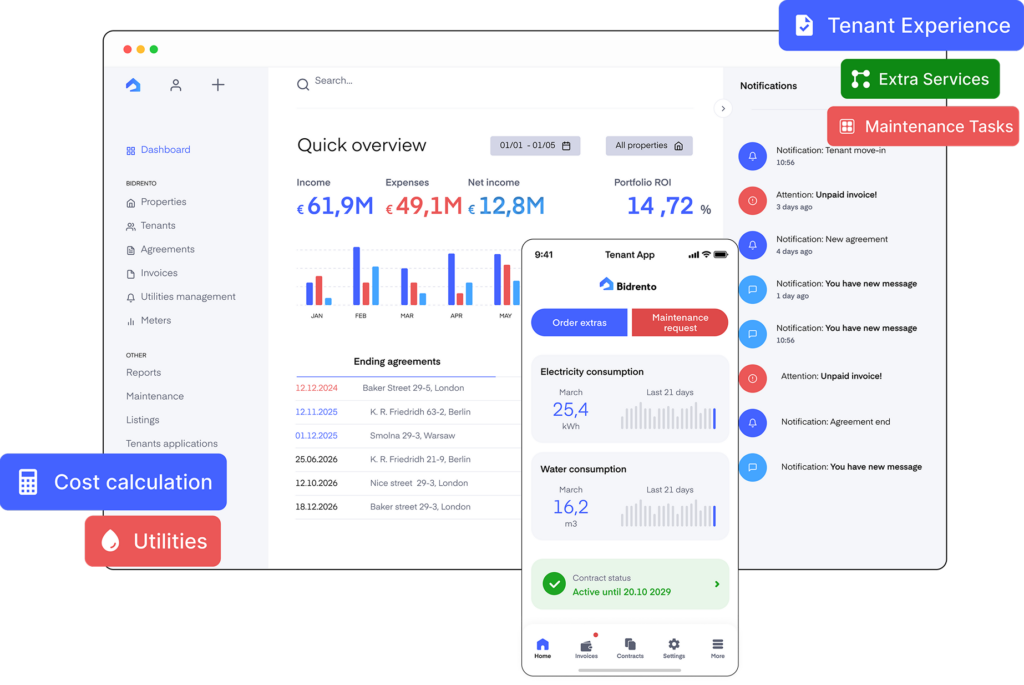

This is why Bidrento built a dedicated utility cost calculation module where you set clear rules based on actual meter readings, square meters or custom formulas, then let the system run the math every month.

Once the rules are in Bidrento, the risk of manual mistakes drops. When you then connect Bidrento to e-invoicing software or broader e-invoicing solutions, you get speed and compliance on top of correct numbers.

Multi country leases and VAT rules

Many rental portfolios spread across several European countries. That sounds glamorous at investor meetings. It is less glamorous when you try to reconcile rent and service charge invoices under five different VAT systems.

Examples of where this bites:

- some countries treat most residential rents as VAT exempt

- some service charges must carry VAT even when base rent does not

- hospitality and short stay units follow different rules from long term leases

- indexation methods in the EU vary and may link to different local inflation indices

If you mix that with:

- local service charge codes

- local service charge best practice standards

- local consumer and landlord and tenant regulation

then you get a messy picture unless you design your systems well.

Here e-invoicing software and e-invoicing solutions earn their keep. They:

- map VAT codes to each country’s requirements

- generate e-invoices in formats that tax offices and business tenants accept

- keep timestamps, IDs and status logs for audits

They do not decide which costs belong to which VAT code. That still sits in your property and tax design. For that you need a property system that understands building types, unit types and local rules, plus tax advice for edge cases.

When Bidrento sits at the property level and exports structured invoice data into e-invoicing software, landlords can keep a single view of leases and VAT logic.

Human factors, how teams trip over their own tools

There is also a human side to this story. Property management teams often waste time because of poor payment and billing workflows, not only because of bad tenants. Common patterns include:

- accepting paper cheques or manual bank transfers for rent

- key billing steps sitting with one “hero” colleague

- weak handover notes when staff change

- ad hoc Excel logic with no documentation

The result is:

- delays in issuing invoices

- missed indexation dates

- inconsistent handling of arrears

- more disputes about who said what and when

Solid e-invoicing software and thoughtful e-invoicing solutions help here as well. They bring:

- standard workflows for invoice creation and sending

- clear logs of who did what and when

- automatic payment reminders

- dashboards that show aging and arrears

When those tools connect to a property platform like Bidrento, you also avoid double entry. The same invoice appears in the tenant app, in the landlord overview and in the accounting or e-invoicing logs.

People make fewer mistakes when they do not have to keep three systems in their head. That is as close to a productivity secret as you get in property management.