Here is a small timeline with a big message. By 2030, every EU business that trades across borders will have to report its business invoices digitally to its tax office, usually within two days.

At the same time, the UK will push landlords into full digital record keeping under Making Tax Digital from 2026 onward.

So even if no one has called you yet, regulators in Brussels, Berlin, Warsaw, Madrid, Valletta, Tallinn and London have already planned your next round of software upgrades. That is why good e-invoicing software is moving from a “nice tool” to “must have”.

Let us walk through this calmly, country by country, and see what it means for a rental portfolio.

The ViDA spine, how the EU wants e-invoices to behave

The EU’s “VAT in the Digital Age” package, ViDA for short, has one clear idea at the centre. Every cross border business to business invoice should be born as structured data and reported quickly to tax offices.

In practice this means:

- invoices follow the EN 16931 e-invoicing standard

- data goes to tax offices in near real time

- many paper and PDF based derogations will vanish over time

Under ViDA, e-invoicing and e-reporting sit “at the centre” of VAT control, not as a side channel.

For a landlord this matters because:

- every rent invoice to a business tenant in another EU state will be part of this flow

- service charges and utility costs in mixed use buildings will feed the same data stream

- late or wrong invoices become more visible, more quickly

Strong e-invoicing software and well built e-invoicing solutions are the easiest way to match this future. Trying to build custom export files in a spreadsheet will feel like bringing a pen knife to a chess match.

Estonia and the Baltic view, e-invoicing as the new default

Estonia, as an innovative digital-first society, is a useful bellwether for landlords who like to plan early.

- Since 2019, electronic invoices are mandatory for all businesses to government deals.

- From July 2025, a new regime gives every accounting entity registered as an e-invoice recipient the right to receive EN 16931 standard e-invoices by default, both B2G and B2B.

In plain terms, if your tenant or supplier in Estonia registers as an e-invoicing party, you must be able to send or receive proper e-invoices.

This is where e-invoicing software already acts like plumbing. The right e-invoicing solutions:

- speak EN 16931 fluently

- send invoices over networks like Peppol

- connect to platforms that the Estonian tax office and public sector accept

For Baltic portfolios with units in Estonia and Latvia or Lithuania, this creates a simple rule. You want e-invoicing software that handles cross border rules as one system, not three separate hacks.

Germany, from paper to structured e-invoicing discipline

Germany has been famous for long paper trails. That phase is ending.

- From 1 January 2025, Germany will treat e-invoicing as the default method for B2B invoices under the Growth Opportunities Act.

- Companies must be ready to receive e-invoices in EN 16931 formats from that date, even if sending duties phase in over time.

- Local hybrids like ZUGFeRD and Factur-X now align with EN 16931 as well.

For a landlord with German assets this means:

- business tenants may start asking for structured e-invoices as part of their own compliance

- your German entities must store and retrieve those invoices for audits

- generic PDFs start to look more like a liability than a comfort

Good e-invoicing software for Germany will:

- generate EN 16931 compliant invoices

- handle ZUGFeRD and Factur-X where needed

- keep a clean audit trail of every change and status

For portfolios with Germany plus other EU states, cross border e-invoicing solutions become even more useful, because you avoid a different manual workaround in each country.

Poland, KSeF and the central e-invoicing hub

Poland gives a clear picture of where many EU states are headed.

- Poland is rolling out the National e-Invoicing System, KSeF

- From February 2026 for large firms and April 2026 for others, B2B e-invoicing will be mandatory via this central platform.

- All VAT taxpayers with a seat or fixed establishment in Poland will have to issue structured invoices through KSeF

The tax carrot is simple. Poland offers faster VAT refunds for those who use KSeF. The stick is clear too. If your invoices do not pass through the system, they do not count in the same way.

For real estate groups with Polish companies this means:

- every rent invoice

- every service charge

- every utility recharge

will have to go through KSeF as a structured file. Manual uploads will grow old very fast.

You will want e-invoicing software or broader e-invoicing solutions that:

- link directly to KSeF

- map property level invoice lines to the right tax codes

- pull status messages back into your property and finance systems

Trying to do this with hand built files is a good way to train your patience, but not your portfolio.

Spain is getting serious with e-invoicing with Crea y Crece & SII

Spain runs two strong levers at the same time.

- The Crea y Crece law brings mandatory B2B e-invoicing in stages, with large firms over 8 million euro turnover expected to comply first, followed by smaller firms later.

- The SII model already forces larger taxpayers to send VAT ledger data to the tax agency within a few days of issuing or receiving invoices.

This pushes Spanish businesses toward:

- structured invoices

- quick reporting of invoice status, including payment, rejection and acceptance

For landlords in Spain, or for groups with Spanish subsidiaries, strong e-invoicing software is more than a convenience. When Crea y Crece fully applies, you will need e-invoicing solutions that:

- produce e-invoices in formats that match Spanish rules

- report status updates within the short SII deadlines

- keep a tight link between property level data and VAT records

A missed or late invoice line for shared energy in one retail centre may turn into a question from the tax office within days, not years.

Malta and smaller states, Peppol culture, and public anchors

Malta looks small on a map, but its e-invoicing moves deserve attention.

- Malta has adopted the EN 16931 standard for public procurement

- public bodies use Peppol BIS Billing 3.0 to receive e-invoices through the Peppol network

The Ministry of Finance explains Peppol as a common framework for secure cross border exchange of orders and invoices, used by both public and private bodies.

For landlords this matters in two ways:

- if you rent to public sector tenants, they may ask for Peppol based e-invoices

- once public bodies use e-invoicing by default, private firms often follow over time

E-invoicing software that can talk to Peppol and handle multiple countries will save you from a tangle of local portals. A single, well designed e-invoicing solution that works for Malta, Germany, Poland and Spain is far easier to maintain than five local hacks.

UK, Making Tax Digital and the landlord squeeze

The UK has not yet moved to full B2B e-invoicing mandates across the board. It has taken a different path. First VAT, then income tax.

Key points for landlords:

- Since April 2022, all VAT registered businesses must keep digital VAT records and file returns through MTD compatible software

- From April 2026, landlords with more than £50,000 in property and self-employment income must keep digital records and send quarterly updates under Making Tax Digital for Income Tax. Thresholds drop to £30,000 in 2027 and £20,000 in 2028.

- Late filing penalties for MTD filers will increase from 2025, which puts more pressure on clean, timely records.

While the UK does not yet force structured EN 16931 invoices for all B2B deals, the direction is clear. Landlords have to:

- move to digital ledgers

- use recognised software

- submit data in set formats on fixed dates

In this setting, e-invoicing software and e-invoicing solutions help in two ways. They:

- create structured, traceable invoices that tie neatly into MTD compatible accounting tools

- give you clear reports on rent, arrears and charges that match what HMRC will see

A landlord who already uses proper e-invoicing software will feel much less stress when MTD dates arrive.

What this all means for you as a landlord

A simple big picture forms. By the end of this decade:

- the EU will expect near real time invoice data for cross border deals

- many member states will run national platforms or tight reporting rules

- the UK will expect digital records and regular updates from landlords

- public bodies across Europe will see e-invoicing as their default

For a rental portfolio that owns assets anywhere in Estonia, Germany, Poland, Spain, Malta or the UK, this means three clear moves:

- Pick serious e-invoicing software

- support for EN 16931

- links to Peppol and national portals

- strong e-reporting functions

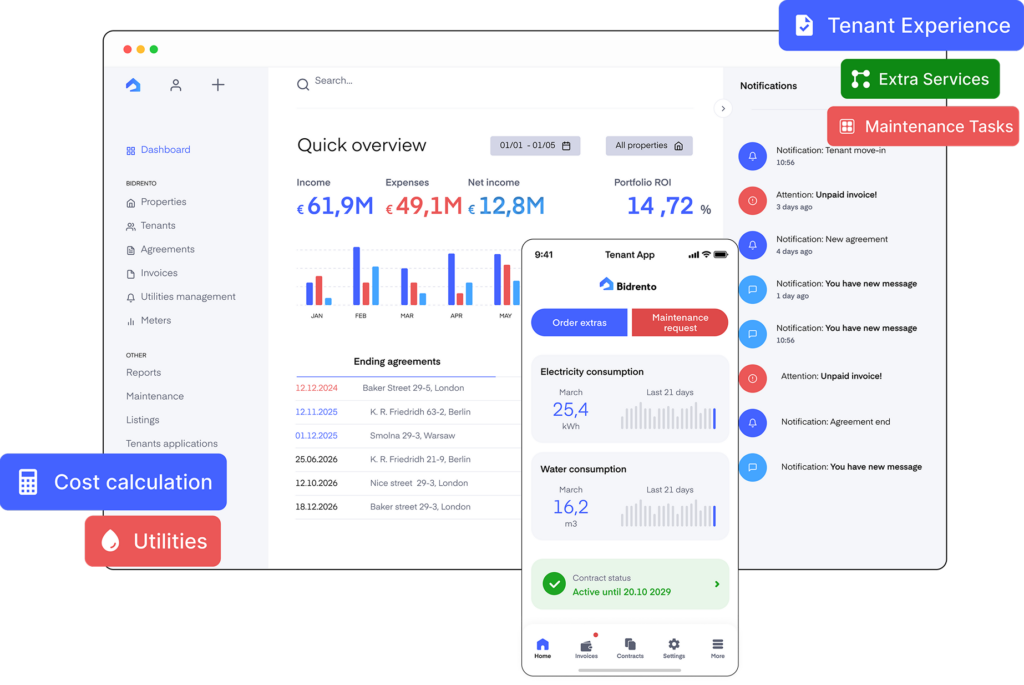

- Use sector tools for real estate logic

- platforms like Bidrento to handle leases, utilities and shared costs

- clean export of invoice data toward your chosen e-invoicing solutions

- Avoid short term patches

- manual uploads to each national system

- one off scripts built inside spreadsheets

Good property management software with e-invoicing will keep you aligned with tax rules. Bidrento will keep your rent and service charge logic tidy at the same time. That is a calm place to be when tax offices start asking more questions, more often.